The life insurance market in Brazil is experiencing significant growth, driven by increasing awareness of financial protection, economic development, and the expansion of digital services. This article delves into the current state of the Brazilian life insurance market, its key drivers, challenges, and future prospects.

Overview of the Brazilian Life Insurance Market

Brazil is the largest economy in Latin America, and its life insurance market is one of the most dynamic and rapidly evolving sectors. In recent years, the market has seen impressive growth due to economic recovery, rising income levels, and growing consumer awareness about the importance of financial security.

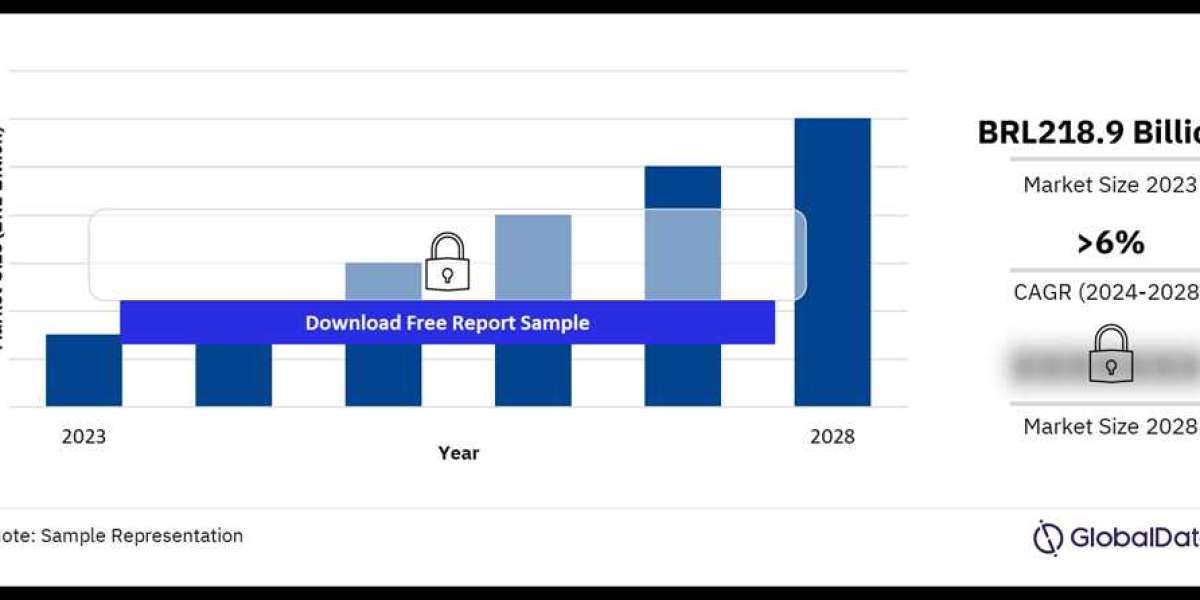

As of 2024, the life insurance market in Brazil is valued at approximately USD 20 billion, with expectations for continued expansion. The market's growth is primarily fueled by an increase in disposable income, demographic shifts, and advancements in technology that make insurance products more accessible.

Key Drivers of Market Growth

Economic Recovery and Rising Income Levels: Brazil's economic recovery has increased disposable income, which has positively impacted the life insurance market. More individuals are now able to afford life insurance policies as part of their financial planning.

Growing Middle Class: The expanding middle class in Brazil has led to higher demand for life insurance as people seek to protect their families and secure their financial futures.

Digital Transformation: The rise of digital platforms and Insurtech companies has revolutionized how life insurance is distributed and consumed in Brazil. Digital channels offer consumers easier access to products, personalized policies, and faster claim processing.

Increased Awareness of Financial Protection: Public awareness campaigns by insurance companies and government initiatives have educated Brazilians about the importance of life insurance. This has helped bridge the gap between demand and supply.

Regulatory Support: The Brazilian government has introduced favorable regulations that encourage insurance penetration. Regulatory bodies are working to simplify processes and ensure transparency, which has boosted consumer confidence.

Challenges in the Brazilian Life Insurance Market

Low Penetration Rates: Despite growth, life insurance penetration in Brazil remains low compared to other countries. A large portion of the population is still uninsured, particularly in rural areas and among low-income groups.

Economic Volatility: While Brazil's economy is on a recovery path, it remains susceptible to political and economic instability, which can affect consumer spending on discretionary items like insurance.

Lack of Financial Literacy: A significant challenge is the lack of financial literacy among many Brazilians. This limits their understanding of life insurance products and their benefits, resulting in lower uptake rates.

Competition and Pricing Pressure: The market is highly competitive, with both local and international insurers vying for market share. This competition leads to aggressive pricing strategies, which can impact profitability.

Opportunities in the Market

Expanding Digital Offerings: The digital transformation of the insurance sector presents a significant opportunity for growth. Insurtech firms are at the forefront, offering innovative solutions such as AI-driven risk assessments, digital claims processing, and personalized policy recommendations.

Targeting Underserved Markets: There is substantial opportunity to tap into underserved segments, including low-income households, small businesses, and rural areas. Microinsurance products, which offer affordable coverage, are gaining traction as a way to reach these populations.

Product Innovation: Insurers are innovating to offer more flexible and customized life insurance products that cater to specific needs, such as term life, whole life, and investment-linked policies. This diversity attracts a broader audience and addresses various financial planning needs.

Partnerships and Collaborations: Collaborations between traditional insurers and fintech or insurtech companies can drive product innovation and improve service delivery, enhancing the overall customer experience.

Future Outlook

The future of the Brazilian life insurance market looks promising, with expectations of steady growth over the next decade. Key trends that will shape the market include the continued digitalization of insurance services, a focus on customer-centric products, and the expansion of microinsurance to reach underserved populations.

Additionally, insurers are likely to invest in data analytics and AI to better understand customer needs and improve risk management. Sustainability and ESG (Environmental, Social, and Governance) factors are also expected to play a larger role in shaping life insurance products, aligning them with broader societal goals.

Buy the Full Report to Gain More Information about the Brazil Life Insurance Market Forecast