This article delves into the intricate world of iron ore mining, exploring its market size, key players, driving forces, and the challenges that lie ahead.

Market Landscape: A Billion-Dollar Industry

The iron ore mining market is a behemoth, with estimates suggesting a valuation of over USD 3 billion in 2022 [1]. Market research predicts a healthy growth trajectory, with projections reaching USD 6.09 billion by 2032, reflecting a compound annual growth rate (CAGR) of approximately 7.8% [1]. This growth is fueled by several factors, including:

- Rising Steel Demand: Steel remains the cornerstone of global infrastructure development. The construction industry, particularly in developing economies, is witnessing a boom, driving up demand for iron ore, the primary ingredient in steel production.

- Infrastructure Expansion: From high-speed rail networks to sprawling urban centers, the need for robust infrastructure is propelling the iron ore market. Steel is the go-to material for bridges, buildings, and transportation systems, creating a direct link between infrastructure growth and iron ore consumption.

- Industrialization Wave: Developing nations are experiencing rapid industrialization, leading to a surge in demand for machinery, equipment, and automobiles. Steel, a key component in these sectors, translates to a heightened requirement for iron ore.

Global Players: A Geopolitical Chessboard

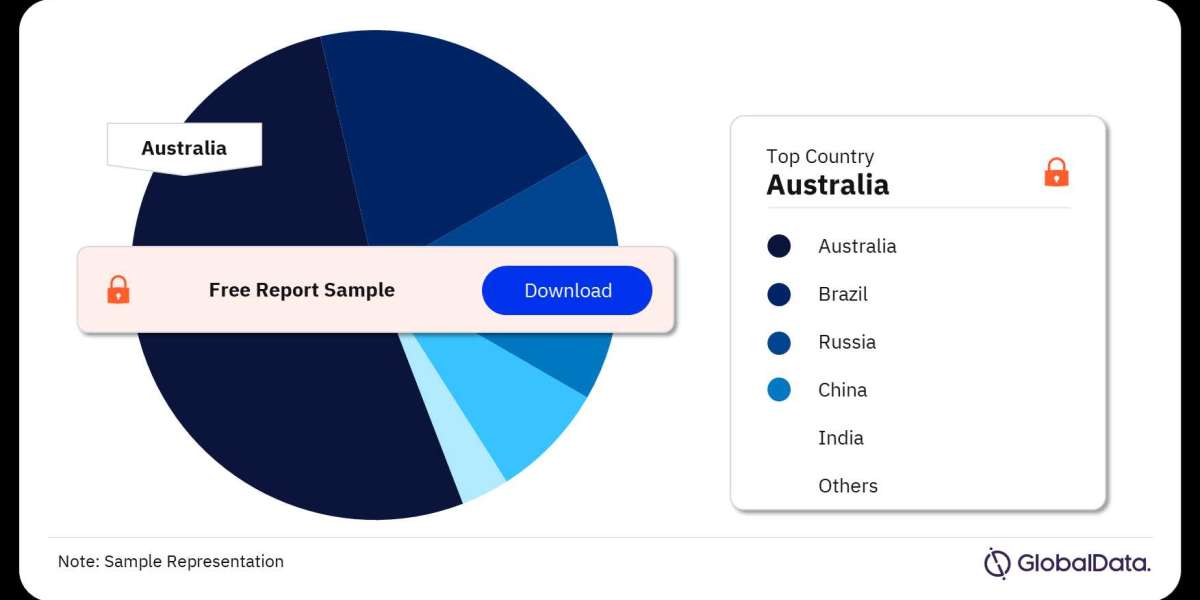

The iron ore mining market is a geopolitically significant landscape dominated by a handful of key players:

- Australia: The reigning champion, Australia boasts vast iron ore reserves and is the world's leading producer, accounting for an estimated 880 million metric tons in 2022 [2]. Major Australian miners include BHP, Rio Tinto, and Fortescue Metals Group.

- Brazil: A close contender, Brazil sits atop substantial iron ore deposits and produces around 410 million metric tons annually [2]. Vale, a Brazilian mining giant, is a dominant force in the global market.

- Other Significant Producers: Several other countries play a crucial role, including China, India, South Africa, and Russia. These nations contribute significantly to the global iron ore supply chain.

China: The Iron Magnet

While Australia and Brazil lead in production, China reigns supreme as the world's largest iron ore importer. A staggering two-thirds of global iron ore exports, exceeding one billion metric tons, find their way to Chinese shores [2]. This dependence on a single consumer creates a complex market dynamic, with China wielding significant influence over iron ore prices.

Market Segmentation: A Matter of Finesse

The iron ore mining market can be segmented based on the type of ore extracted:

- Iron Ore Fines: Dominating the market, iron ore fines are a preferred choice due to their ease of processing and transportation. They are generally lower in iron content compared to other types.

- Iron Ore Lumps: These larger chunks of iron ore require crushing before use but boast a higher iron content than fines.

- Iron Ore Pellets: Engineered for optimal efficiency, pellets are formed by concentrating and agglomerating iron ore fines. They offer the highest iron content but come at a higher production cost.

The Winds of Change: Challenges and Opportunities

The iron ore mining market is not without its challenges. Here are some key factors to consider:

- Sustainability Concerns: The mining process can have a significant environmental impact. Stringent regulations and the growing focus on sustainable practices are pushing miners to adopt eco-friendly extraction methods.

- Price Fluctuations: Iron ore prices are susceptible to global economic fluctuations and geopolitical tensions. This volatility can create uncertainty for miners and steel producers.

- Technological Advancements: Automation and digitalization are transforming the mining industry. While these advancements can improve efficiency and safety, they can also lead to job displacement.

Despite these challenges, exciting opportunities are emerging:

- Exploration for High-Grade Ore: The discovery and extraction of high-grade iron ore deposits can improve profitability and meet the growing demand for efficient steel production.

- Focus on Efficiency: Optimizing mining operations through technological advancements and innovative practices can lead to cost reductions and improved environmental performance.

- Shifting Geopolitical Landscape: The potential for diversification of iron ore supply chains can reduce dependence on a few key players and create a more balanced market dynamic.

The Road Ahead: A Sustainable Future

The iron ore mining market is an essential cog in the global economic machinery. As the world continues to urbanize and industrialize, the demand for iron ore is projected to rise.