Life insurance plays a crucial role in providing financial security to individuals and their families. It helps in managing risks associated with unexpected life events, such as death, disability, or critical illness. Additionally, life insurance products often include investment components that can contribute to long-term financial planning.

Purpose of the Article

This article aims to provide a comprehensive overview of the Brazil life insurance market, including its historical development, current trends, challenges, and future prospects. By exploring various facets of the market, this article seeks to inform consumers, investors, and industry stakeholders about the opportunities and dynamics of life insurance in Brazil.

Market Overview

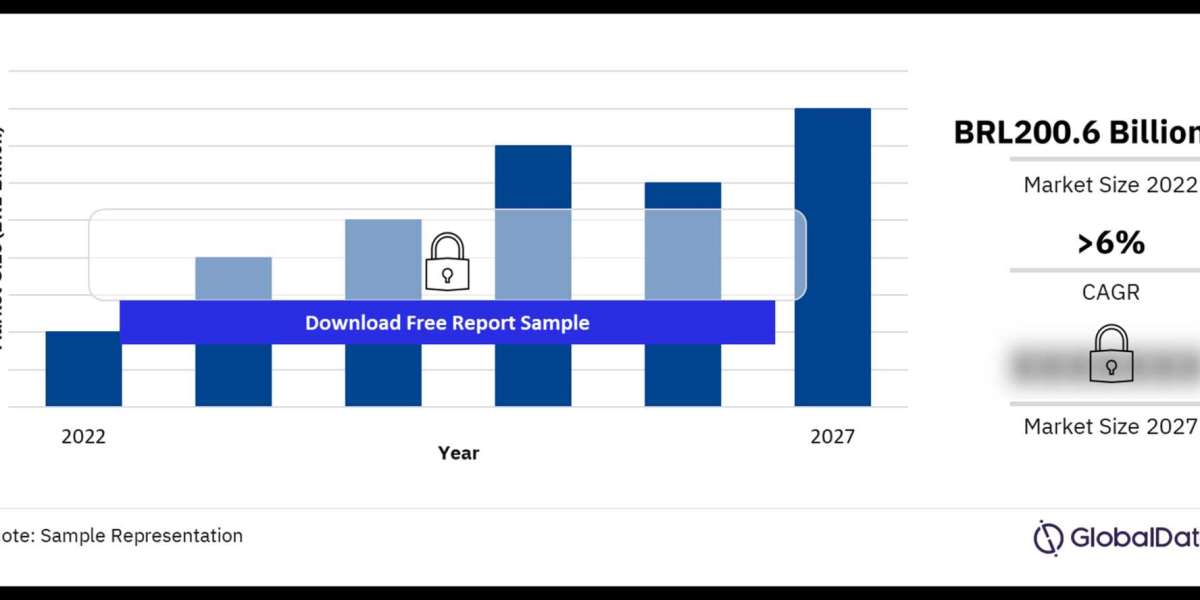

Market Size and Growth

The Brazilian life insurance market has seen robust growth, with a market size reaching billions of reais. The sector has consistently outperformed other financial segments, driven by rising consumer awareness and an expanding middle class. Recent reports suggest an annual growth rate of around 10%, highlighting the market's resilience and potential.

Key Market Players

Some of the prominent players in the Brazilian life insurance market include Bradesco Seguros, Itaú Seguros, and SulAmérica. These companies dominate the market with a significant share, offering a wide range of products tailored to meet diverse consumer needs. International insurers like Zurich and Allianz also play a crucial role, bringing in global expertise and innovation.

Market Segmentation

The market can be segmented based on product types, distribution channels, and demographic factors. Key product segments include term life, whole life, and universal life insurance. Distribution channels range from traditional agents to digital platforms, while demographic segmentation considers factors like age, income, and geographic location.

Historical Context

Evolution of Life Insurance in Brazil

Life insurance in Brazil has a rich history, dating back to the 19th century. Initially, the market was dominated by a few domestic companies. Over time, regulatory reforms and economic liberalization attracted foreign insurers, leading to increased competition and innovation.

Key Milestones

Several milestones have shaped the Brazilian life insurance market, including the introduction of mandatory life insurance for specific sectors, the liberalization of the insurance market in the 1990s, and recent digital transformation initiatives that have revolutionized how insurance products are sold and managed.

Regulatory Changes and Their Impact

Regulatory changes have had a profound impact on the market, influencing product offerings, pricing strategies, and consumer protection measures. The establishment of SUSEP (Superintendência de Seguros Privados) as the regulatory body has ensured better oversight and compliance, fostering a more transparent and competitive market.

Types of Life Insurance

Term Life Insurance

Term life insurance is a popular product in Brazil, providing coverage for a specified period. It is often chosen for its affordability and straightforward structure, making it an ideal choice for individuals seeking temporary protection.

Whole Life Insurance

Whole life insurance offers lifelong coverage, combining a death benefit with a savings component. This type of insurance is favored for its stability and potential for cash value accumulation, serving both protection and investment needs.

Universal Life Insurance

Universal life insurance provides flexible premium payments and adjustable death benefits. It allows policyholders to modify their coverage as their financial situation changes, offering a blend of protection and investment features.

Variable Life Insurance

Variable life insurance includes investment options within the policy, allowing policyholders to allocate premiums to different investment accounts. This product appeals to those willing to take on investment risks in exchange for potentially higher returns.

Market Trends

Technological Advancements

The Brazilian life insurance market has embraced technological advancements, particularly in digital platforms and insurtech solutions. Innovations such as artificial intelligence, big data analytics, and mobile applications are enhancing customer experiences and operational efficiencies.

Consumer Preferences

Consumer preferences are shifting towards personalized and flexible insurance products. There is a growing demand for policies that offer tailored coverage and investment options, reflecting individual financial goals and risk appetites.

Buy Full Report to Gain More Information about the Brazil Life Insurance Market Forecast