The roots of Bermuda's insurance industry trace back to the mid-20th century when pioneering entrepreneurs recognized the island's potential as a domicile for international insurance and reinsurance companies. The jurisdiction's strategic location, political stability, and business-friendly regulations laid the groundwork for exponential growth in the decades to come.

One of the key innovations that propelled Bermuda to the forefront of the insurance world was the creation of the captive insurance market. Captive insurance companies, established by corporations to underwrite their own risks, found Bermuda's regulatory framework particularly conducive. This led to a proliferation of captives, enhancing Bermuda's reputation as an innovative and flexible jurisdiction.

A Global Hub for Reinsurance

While captives played a significant role in Bermuda's insurance landscape, it was the reinsurance sector that truly solidified the island's position as a global insurance hub. Bermuda emerged as a leading domicile for reinsurance companies, attracted by its favorable tax environment, regulatory sophistication, and proximity to major insurance markets in North America and Europe.

Bermuda's insurance industry gained international prominence following major catastrophic events such as Hurricane Andrew in 1992 and the 9/11 terrorist attacks. Reinsurers based in Bermuda demonstrated their resilience and capacity to absorb large losses, earning the trust of clients worldwide.

Regulatory Excellence

Central to Bermuda's success as an insurance jurisdiction is its robust regulatory regime. The Bermuda Monetary Authority (BMA), the island's financial regulator, oversees the insurance industry with a focus on prudential supervision, risk management, and consumer protection.

Bermuda's regulatory framework is characterized by a balance between maintaining high standards and fostering innovation. The BMA works closely with industry stakeholders to ensure compliance with international best practices while facilitating the introduction of new products and services.

Diversification and Resilience

In recent years, Bermuda's insurance industry has witnessed diversification beyond traditional reinsurance. The island has become a hub for insurance-linked securities (ILS), attracting investors seeking alternative risk transfer mechanisms such as catastrophe bonds and collateralized reinsurance.

Additionally, Bermuda has positioned itself as a center for specialty insurance and niche markets. Companies operating in sectors such as aviation, healthcare, and cyber insurance have found Bermuda to be an ideal domicile due to its regulatory expertise and market access.

Looking Ahead: Opportunities and Challenges

As Bermuda's insurance industry continues to evolve, it faces both opportunities and challenges on the horizon. The growing demand for risk management solutions in an increasingly complex global economy presents ample opportunities for innovation and growth.

However, the sector also grapples with ongoing challenges, including regulatory compliance, cybersecurity threats, and the impact of climate change on insurable risks. Navigating these challenges will require collaboration between industry participants, regulators, and other stakeholders to ensure the continued success and resilience of Bermuda's insurance sector.

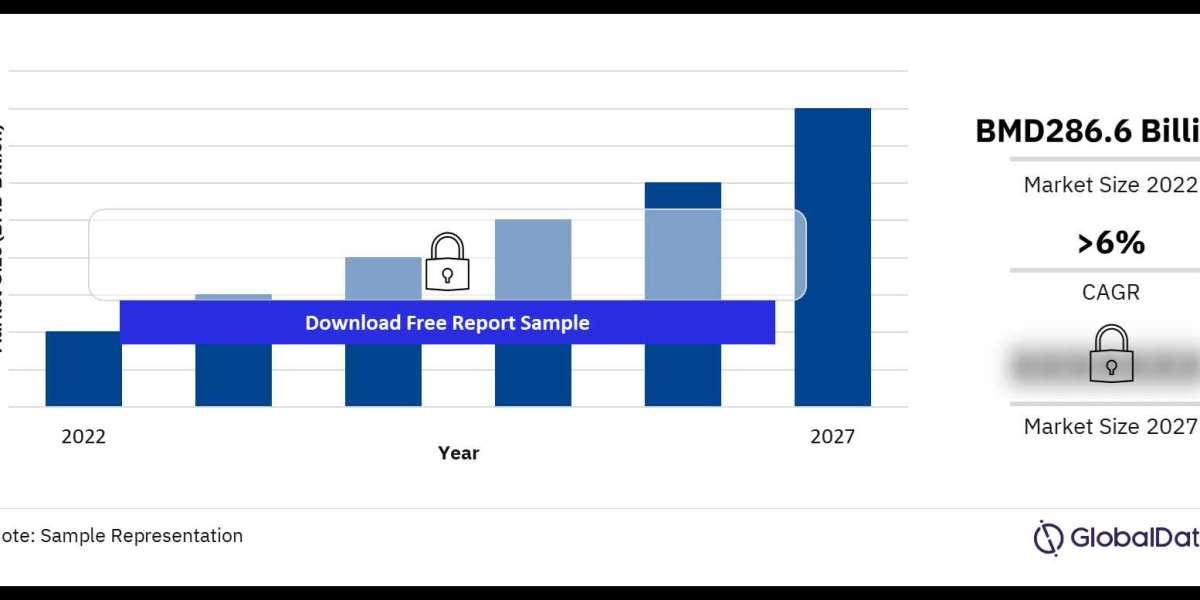

Buy the Full Report or Download a Free Sample Report for Bermuda’s Insurance Industry Forecasts