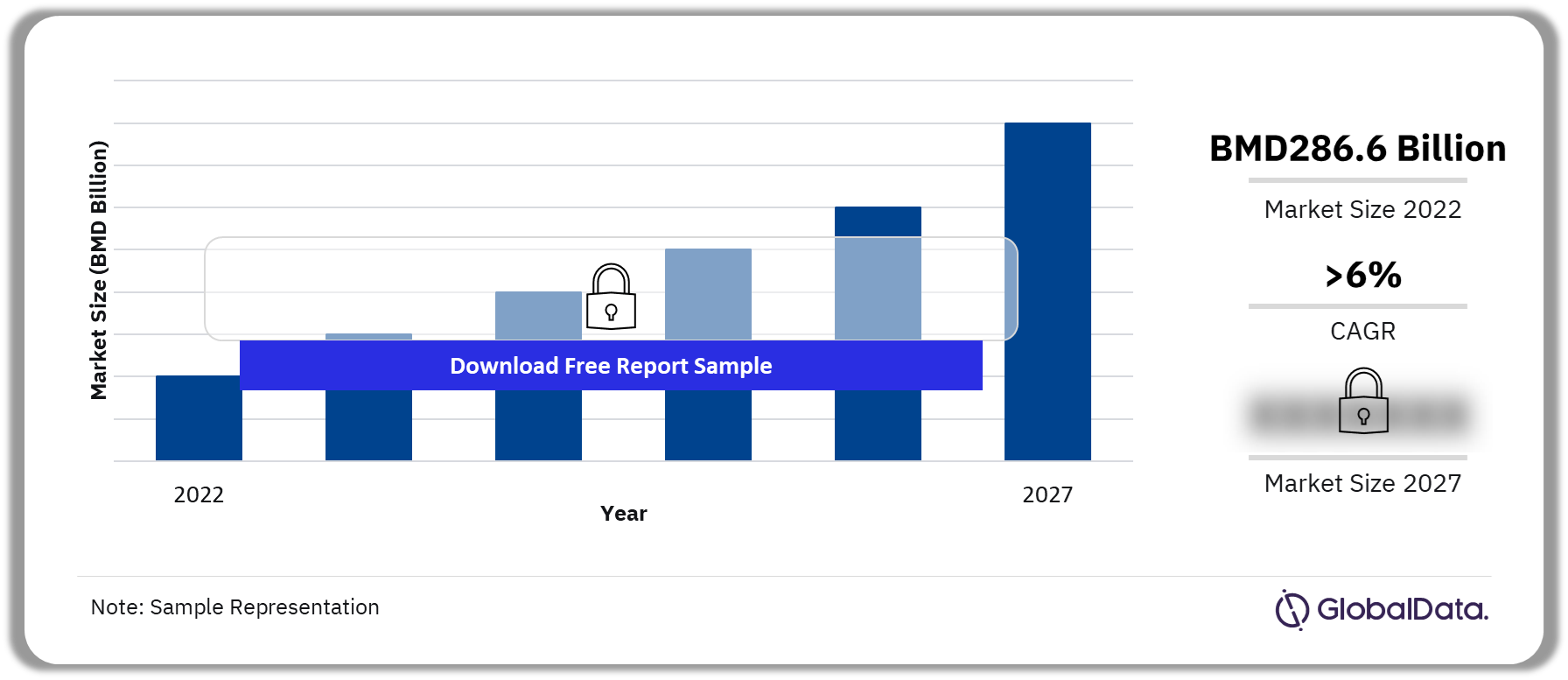

The Bermuda insurance market has long been recognized as a global hub for insurance and reinsurance, characterized by its unique regulatory environment, diverse offerings, and strong capital base. Bermuda’s favorable tax regime, combined with its political stability and commitment to regulatory compliance, positions it as an attractive destination for global insurance and reinsurance firms.

Buy the Full Report or Download a Free Sample Report for Bermuda’s Insurance Industry Forecasts

Key Trends Shaping the Bermuda Insurance Market

Several key trends are currently shaping the Bermuda insurance market:

Growth of Alternative Risk Transfer: The demand for alternative risk transfer solutions, such as insurance-linked securities (ILS) and catastrophe bonds, has surged in recent years. Bermuda has become a leading jurisdiction for ILS, providing a flexible and efficient framework for managing risk. This trend is driven by the need for insurers to enhance their capital efficiency and manage exposure to catastrophic events.

Digital Transformation: The insurance industry is undergoing a digital revolution, and Bermuda is no exception. Insurers are increasingly leveraging technology to streamline operations, enhance customer experiences, and improve risk assessment. The adoption of data analytics, artificial intelligence, and blockchain is transforming traditional insurance models, allowing for more personalized products and faster claims processing.

Increased Regulatory Scrutiny: While Bermuda’s regulatory framework has historically been favorable, there is a growing trend of increased scrutiny from international regulatory bodies. Insurers operating in Bermuda must navigate evolving compliance requirements and demonstrate transparency and accountability. This trend emphasizes the importance of maintaining strong governance practices and risk management strategies.

Focus on Climate Change and Sustainability: The impact of climate change is becoming a focal point for insurers globally. In Bermuda, insurers are increasingly integrating environmental, social, and governance (ESG) factors into their risk assessments and underwriting processes. This shift is driven by the need to address the growing frequency and severity of climate-related events, such as hurricanes and floods.

Growth Drivers for the Bermuda Insurance Market

Several factors are driving growth in the Bermuda insurance market:

Global Reinsurance Demand: As the global demand for reinsurance continues to rise, Bermuda’s reinsurance sector stands to benefit significantly. The island’s established reputation and expertise in providing reinsurance solutions make it a preferred destination for cedents seeking coverage for complex risks.

Strategic Partnerships: Collaborations between local insurers and international reinsurers are becoming increasingly common. These partnerships allow for knowledge sharing, risk diversification, and the development of innovative insurance products. By leveraging local expertise and global resources, insurers can better serve their clients and enhance competitiveness.

Market Resilience: The Bermuda insurance market has demonstrated resilience in the face of challenges, including natural disasters and economic downturns. The ability to adapt and respond to changing market conditions positions the sector for sustained growth. Insurers are focused on developing robust risk management strategies to navigate uncertainties and maintain profitability.

Investment Opportunities: Bermuda’s attractive investment environment continues to draw capital into the insurance sector. Investors are increasingly seeking opportunities in innovative insurance products, ILS, and technology-driven solutions. This influx of capital supports the growth of new ventures and enhances the overall competitiveness of the market.