The Algerian defense market has become a critical point of focus in North Africa, driven by the country’s growing investment in military capabilities and national security. Algeria, as one of the largest economies in Africa, has been consistently increasing its defense budget, positioning itself as a key player in regional security dynamics. This article provides an in-depth analysis of the Algeria defense market, including its current landscape, key drivers, and future prospects.

Market Overview

Algeria’s defense market is one of the largest in Africa, fueled by both internal and external factors. With a defense budget hovering around $10 billion annually, Algeria ranks among the top defense spenders on the continent. This considerable financial allocation is largely driven by the need to maintain security amid rising threats from terrorism, insurgency, and geopolitical tensions in the broader MENA (Middle East and North Africa) region.

The primary focus areas of Algeria’s defense sector include:

- Land forces modernization: The bulk of Algeria’s defense expenditure is directed towards modernizing its land forces, with investments in tanks, armored vehicles, and artillery systems.

- Air defense systems: Algeria is making significant strides in upgrading its air defense capabilities, notably acquiring advanced fighter jets and missile defense systems.

- Naval expansion: Recent years have seen a growing focus on maritime security, particularly in the Mediterranean Sea, with Algeria investing in new frigates, submarines, and other naval vessels.

Key Drivers of Growth

Several factors are propelling the growth of Algeria’s defense market:

Regional Instability and Border Security

Algeria shares borders with several volatile regions, including Mali, Libya, and Tunisia, where insurgent groups and extremist organizations have been active. The country has consistently prioritized defense spending to safeguard its borders and maintain internal stability.Terrorism Threats

The rise of terrorist networks in the Sahel region has significantly influenced Algeria’s defense strategy. In response, the government has ramped up its spending on counter-terrorism operations, including investments in intelligence, surveillance, and reconnaissance (ISR) systems.Modernization and Technology Transfer

Algeria has been proactive in seeking technology transfer agreements with global defense contractors. This initiative is aimed at modernizing its defense infrastructure and increasing domestic production capabilities, particularly in areas such as electronics, aerospace, and armored vehicle manufacturing.Diversified Procurement Partnerships

Unlike some countries that rely heavily on one supplier, Algeria has adopted a diversified procurement strategy. It sources defense equipment from several global players, including Russia, China, Germany, and Italy, to avoid over-dependence and ensure a robust and versatile defense capability.

Key Players in Algeria’s Defense Market

Several international companies are deeply involved in Algeria’s defense procurement and partnerships:

- Rosoboronexport (Russia): Russia remains one of Algeria’s primary defense suppliers, providing advanced fighter jets, tanks, and missile systems.

- China National Precision Machinery Import and Export Corporation (China): China has been a growing supplier of military hardware, particularly in air defense and unmanned aerial vehicles (UAVs).

- Thales Group (France): France maintains a significant presence in Algeria’s defense market, particularly in telecommunications, radar systems, and naval equipment.

Challenges Facing the Market

Despite its impressive defense spending and modernization efforts, Algeria faces several challenges in its defense market development:

- Dependence on Oil Revenues: Algeria’s economy is heavily reliant on oil exports, and fluctuations in oil prices can directly impact the defense budget.

- Limited Domestic Defense Industry: While the country has made strides in technology transfer, it still depends heavily on foreign suppliers for its defense equipment.

- Geopolitical Tensions: Algeria’s geopolitical position in North Africa places it in the middle of various tensions, including disputes with Morocco and involvement in counterterrorism efforts in the Sahel. These tensions can complicate defense procurement and strategy.

Future Outlook

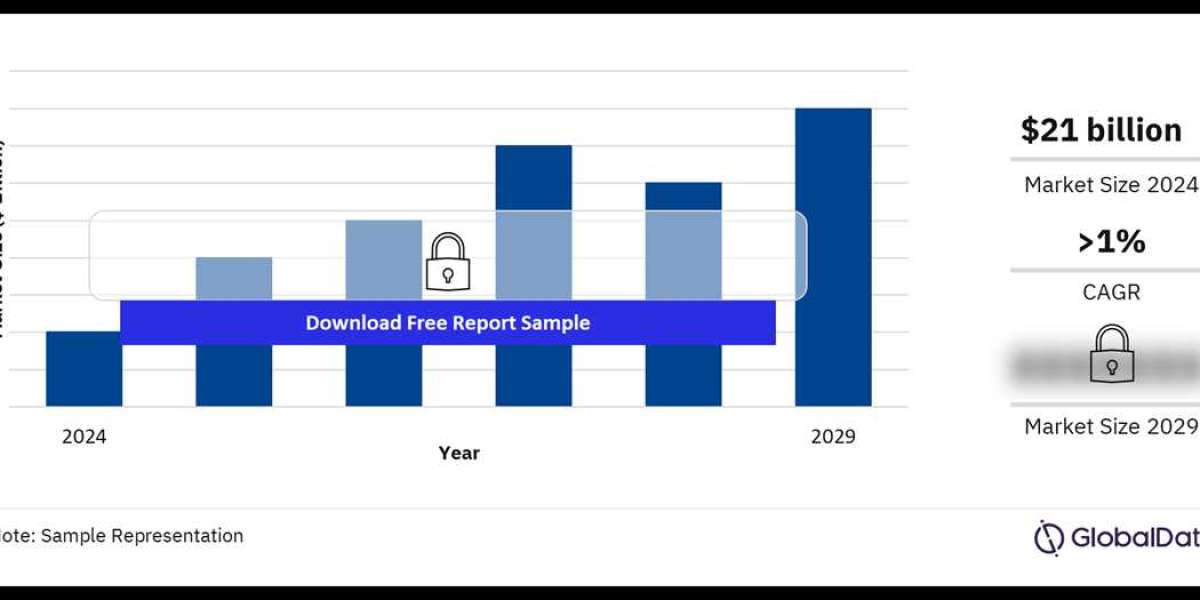

The Algerian defense market is expected to grow steadily over the next decade, driven by increasing regional threats and the need for continuous modernization. Algeria’s government is committed to enhancing its military capabilities, which will continue to attract global defense suppliers. In addition, the country is likely to increase its investment in cybersecurity and space defense, aligning with global trends in military innovation.

Moreover, domestic production will play a more significant role as Algeria seeks to reduce its dependence on foreign suppliers and develop a self-sustaining defense industry. As part of this strategy, Algeria is expected to form more joint ventures with international defense companies, boosting local manufacturing capabilities.

Buy the Full Report for More Insights into the Algeria Defense Market Forecast