The UK food and grocery retailing market is one of the largest and most dynamic sectors in the country. With an increasing population, evolving consumer habits, and emerging technologies, the sector has experienced significant changes over the past few years. In this article, we delve into the key trends, players, and growth opportunities in the UK food and grocery retailing market, while also examining the challenges and future outlook.

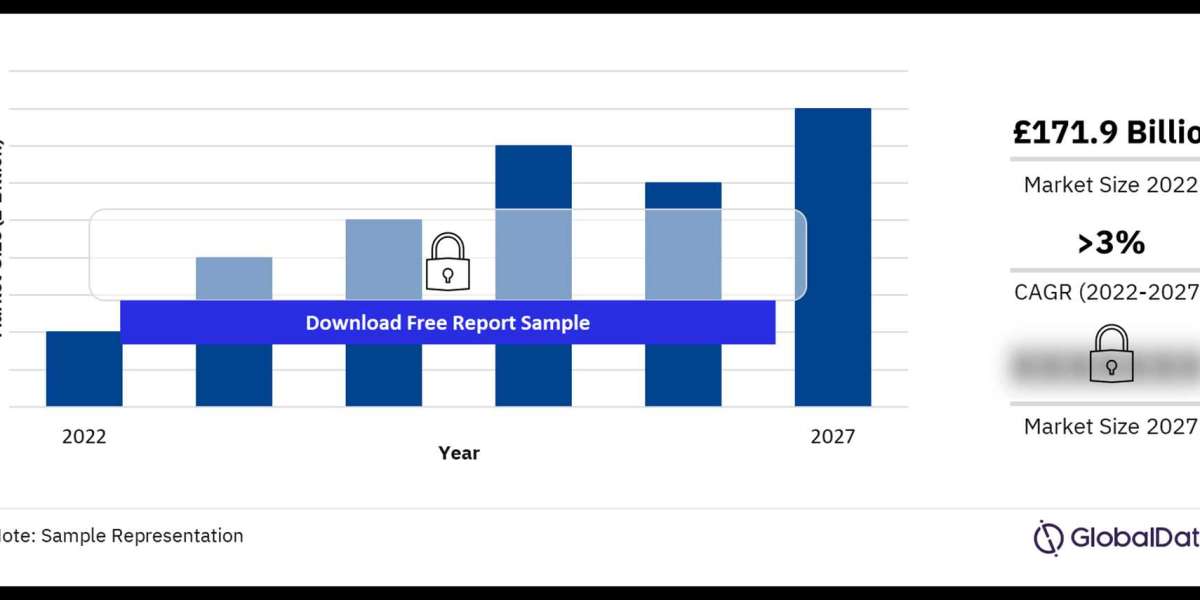

Market Size and Growth

As of 2024, the UK grocery market is valued at around £220 billion, making it one of the top retail markets in Europe. The market is expected to grow at a steady pace, driven by factors such as urbanization, population growth, and changes in consumer preferences. The shift towards online grocery shopping, which accelerated during the COVID-19 pandemic, has continued to gain traction, with consumers increasingly prioritizing convenience and home delivery options.

Key Trends Shaping the Market

Online Grocery Shopping

The online grocery market in the UK has grown rapidly in recent years. Online sales now account for more than 13% of the total food and grocery retailing market. Major retailers like Tesco, Sainsbury’s, and Ocado have strengthened their digital presence and invested heavily in e-commerce platforms and logistics infrastructure. The convenience of online shopping, coupled with the growing demand for same-day or next-day delivery, is set to further boost this segment.Sustainability and Eco-Friendly Practices

Environmental sustainability is becoming a priority for both consumers and retailers in the UK. Shoppers are increasingly opting for products with minimal packaging, locally sourced items, and organic options. In response, supermarkets have introduced initiatives such as reducing plastic packaging, offering plant-based alternatives, and improving supply chain transparency. This shift towards more eco-conscious shopping behaviors is expected to continue as the UK moves toward achieving its net-zero carbon goals.Private Label Products

Private label or store-branded products have seen a rise in popularity in recent years. These products offer consumers an affordable alternative to branded goods without compromising on quality. Retailers like Aldi, Lidl, and Tesco have capitalized on this trend, expanding their private-label ranges across fresh, frozen, and non-food categories. As the cost-of-living crisis persists, private label products are likely to play a larger role in shaping consumer decisions.Health and Wellness Focus

The growing interest in health and wellness has had a notable impact on the UK grocery retailing market. Consumers are seeking healthier food options, such as organic products, free-from items, and plant-based alternatives. Retailers have responded by expanding their ranges of low-sugar, gluten-free, and dairy-free products. Moreover, demand for functional foods, such as those containing probiotics and superfoods, is increasing as consumers focus on boosting immunity and overall well-being.Technological Innovations

Technology continues to play a crucial role in reshaping the grocery shopping experience. In addition to online shopping, innovations such as self-checkout systems, AI-driven inventory management, and automated delivery services are being adopted to enhance customer experience and optimize operations. Retailers are also experimenting with "just walk out" technology, as seen in Amazon Fresh stores, which allows customers to shop without the need to queue or scan items.

Buy the Full Report for More Insights on the UK Food and Grocery Retailing Market, Download Our Free Report Sample